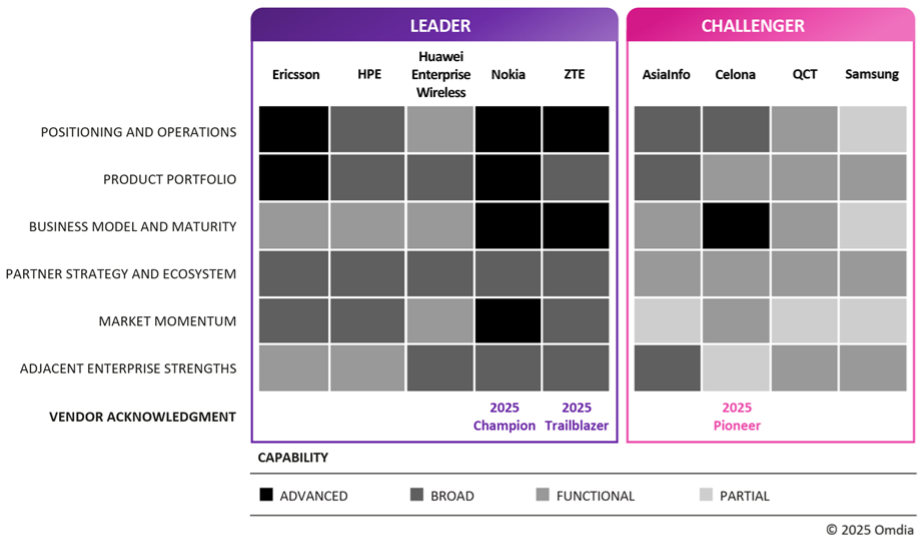

Omdia’s 2025 non-public 5G vendor evaluate locations Nokia high of the pile, main from ZTE, Ericsson, and Celona (as prime movers), and exposing market gaps in technique, distribution, and IT/OT integration throughout the board.

Market leaders – Omdia crowns Nokia as non-public 5G champ, main from ZTE, Ericsson, Celona, and Huawei.

Industrial push – industrial edge and impartial host present eager exercise; not a lot doing with Wi-Fi integration and AI.

Obstacles – IT/OT integration represents the desk stakes for personal 5G; multi-tier distribution doesn’t work.

Everybody loves a league desk, and this one by Omdia is notable as a result of, humbly, we expect it will get it proper – most likely. Actually, it’s a nearer reflection of the RCR view of the runners and riders within the non-public 5G sport. And it really works, versus dogs-dinner concoctions by different analysts (Gartner), as a result of it compares apples with apples. Such that, within the closing evaluation, Nokia ranks high of the seller pile, because the 2025 heavyweight champ (‘2025 Champion’; and never as a ‘challenger’ model behind operators and integrators, largely taking cues from the Finnish agency and its friends). Frankly, it’s a a lot neater train, and a extra logical outcome – which few would correctly argue with in 2025.

As an apart, it is likely to be famous that Kaleido Intelligence ran the rule over the non-public 5G vendor market in January – splitting it in a different way into {hardware}, software program, administration, and enablement disciplines – and got here up with the identical top-line rating, with Nokia forward of NTT Information general, the place the latter scored properly for administration and enablement (Transatel), as wrapped round {hardware} and software program from the likes of Nokia (however largely Celona, really). However the massive shock in Omdia’s straight vendor-review is that Chinese language agency ZTE ranks second, as ‘2025 Trailblazer’, forward of Nokia’s Scandi arch-rival Ericsson, closing quick on the within. Ericsson is one in every of three “leaders”, reckons Omdia.

But it surely doesn’t get a badge. Whereas Celona, the California startup and NTT favorite, does; Omdia hails it as a ‘2025 Pioneer’, one in every of solely three with an “superior” (learn tiered op-ex) enterprise mannequin, and the “first” of any to “goal simplicity in [its] product and pricing – [and] an enterprise-friendly expertise”. For the latter, learn IT-friendly, and be conscious these distributors are subtly selecting IT/OT sides of their options and advertising and marketing. Equally, Omdia displays that any vendor going too laborious on this IT/OT divide has come unstuck. “Those who didn’t bridge the hole between… [have] struggled… Success requires the alignment of each from the outset,” it writes.

On the identical time, Nokia and ZTE, plus the likes of Siemens (which will get a paragraph on the finish as one-to-watch), draw on their OT blueprinting and answer design, the place Celona, Ericsson, and HPE, plus others, push their IT creds. (All of them would dispute such a binary characterisation, however, hey, outdated narratives stick.) Actually that line (IT-friendly) is one Celona likes to make use of, anyway – and one NTT Information likes to make use of about it. Ericsson and Celona are additionally praised, as stand-outs, for his or her work with impartial host methods to overtake indoor wi-fi protection – primarily based on their work within the US, variously with the enterprise groups at T-Cell, AT&T, and Verizon.

Celona presumably ranks fourth, simply exterior the highest spots. So does Huawei (Enterprise Wi-fi), curiously, which should have extra buyer references than another outfit on this league desk. However possibly its China-bent obscures its file considerably, and Omdia doesn’t rank it as “superior” for something in any respect (see picture) – even describing its “place”, “mannequin”, and “momentum” as “purposeful” at greatest. Ouch. On the identical time, Omdia says Huawei has larger enterprise targets – as it’s “betting on large-scale wide-area non-public community alternatives corresponding to grids and railways”. Which exhibits how the market is “maturing” as “solution-driven [and] vertical-focused”, apparently.

Requested about Huawei’s displaying, Pablo Tomasi, the report’s writer (and chair of a associated session at FutureNet World on non-public 5G and AI), stated: “Huawei is targeted totally on public-based non-public 5G networks. Numerous its references and case research in China are [for] hybrid networks. Its concentrate on fully-dedicated non-public 5G has been modest. It’s a strategic alternative. It sees public-based stuff as its greatest guess. What emerged from my engagement with it, earlier than and in the course of the analysis, is it can goal wide-area non-public community alternatives – with utilities, railways and so forth. Apparent to say, but when it needed to concentrate on totally devoted non-public networks it has the capabilities to excel.” Which places us proper.

Of the remaining, Tomasi says HPE, which owns pioneer model Athonet, does “not have a completed product but” – a reference to the absence of home-made RAN to pair with its Athonet core. “As soon as prepared, it might drive a far-reaching enterprise networking imaginative and prescient of Wi-Fi plus non-public 5G.” Samsung has “nice potential” due to “far-reaching experience” however is “but to actually focus”, says Tomasi. Others within the evaluate are: AsiaInfo (“extremely tailor-made options to fulfill sub-vertical wants corresponding to in nuclear power or wind farms”); and QCT (driving “campus networks for Trade 4.0 built-in with edge and AI”). AILINK, Mavenir, and Eviden additionally get a brief profile, together with Siemens.

Actually, as hinted, there are variations in all these distributors’ merchandise, targets, and techniques. Apparently, the evaluate displays on these corporations’ channel actions, suggesting “makes an attempt to create tier two and three (two/three-tiered?) distributor fashions [have] failed”. A press release says: “Distributors now acknowledge that non-public networks are extremely specialised and require a couple of targeted companions – not a large distribution channel.” Which is why all of them are circling round parochial specialists like Future Applied sciences within the US, and Sensible Cell Labs in Germany – and nearly each firm Boldyn Networks has acquired or sought to amass, plus the remaining.

Nokia has taken a nearer hand in its distribution exercise, of late; Ericsson is on a complete appeal offensive within the channel, in the meantime (look on LinkedIn). Of the latter, Omdia says: “Ericsson has the optimum consideration on this market now, although it nonetheless must work on synergies past connectivity – [with] edge, impartial host, community APIs.” However the actual story within the Omdia evaluate is about Nokia and ZTE – one ought to conclude. Nokia is rated as “superior” on 4 out of six measures, and “broad” on each the others (see above); the ratio is flipped for ZTE, which nonetheless locations it increased than each different vendor other than Nokia.

In an e-mail change, Tomasi mirrored: “Nokia units the tempo available in the market. Its first mover benefit is completed, and it wants to point out its industrial bets can drive the corporate past connectivity. ZTE sees non-public 5G as the important thing to driving the transformation of verticals and is working to convey the OT world inside this answer.”

He added: “There’s an amazing focus from most distributors on industrial markets. A few traits/applied sciences that don’t appear to have a huge impact but are the 5G-plus-Wi-Fi story, and AI. Whereas edge and industrial IoT have a tendency are widespread bets, not each participant is clearly making them. Some are targeted on huge areas and others are extra targeted on campus alternatives. Impartial host is an fascinating course however questions stay about its synergy with non-public 5G. Considerably, robust partnerships with industrial gamers are nonetheless missing – most of them are with OEM producers, say, about integrating non-public 5G into mining tools, for instance.”