DeFi, or Decentralized Finance, is a broad notion that refers to monetary providers hosted on and supported by a blockchain.

They use cryptocurrencies to function and get rid of intermediaries, similar to monetary establishments or governments, to conduct transactions.

Anybody with admission to a decentralized community, so is the thought, can borrow/lend cash, get insurance coverage, make worldwide funds, or earn on decentralized exchanges (DEX).

What Is DEX?

A decentralized alternate is a platform the place folks can commerce cryptocurrencies amongst themselves with none interference from a financial institution, dealer, or fee service of any sort.

It supplies full management over one’s funds by permitting customers to purchase and promote crypto in a very automated method.

All DEXs—like Hyperliquid, Raydium, or UniSwap—sit on three main elements: blockchain know-how, sensible contracts, and appropriate crypto wallets like Belief Pockets.

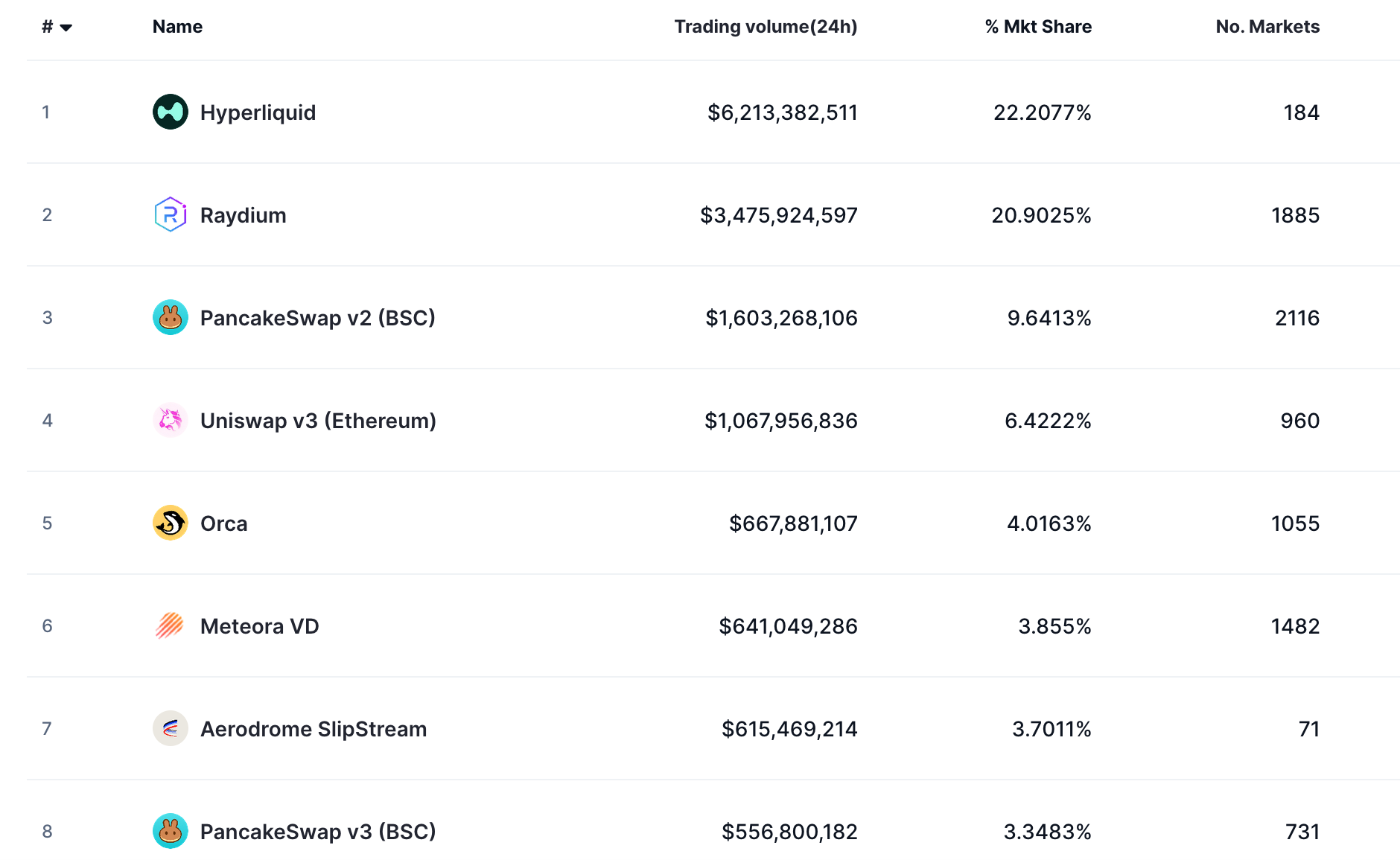

DEXs are booming. For instance, the 24-hour buying and selling quantity of the Hyperliquid alternate platform includes greater than $4.5 billion, whereas the common every day buying and selling quantity throughout all DEXs is round $4.93 billion, up from $4 billion in 2023.

Prime Cryptocurrency Decentralized Exchanges, CoinMarketCap

How Does DEX Work?

Not like Coinbase or some other sort of centralized alternate, DEXs don’t allow you to commerce between fiat and cryptocurrency. They’ll solely allow you to swap one cryptocurrency for one more. Nonetheless, loads of DEXs additionally enable superior buying and selling choices similar to margin buying and selling or inserting restrict orders.

One other vital side is that, throughout the centralized exchanges, buying and selling is maintained by means of an “order e-book,” calculating costs primarily based on present purchase and promote affords—similar to inventory markets like Nasdaq.

In distinction, decentralized exchanges rely on sensible contracts. They use algorithms to set costs of cryptocurrencies, all whereas counting on so-called “liquidity swimming pools” the place buyers can lock in cash to earn rewards whereas serving to drive trades.

Whereas centralized exchanges document transactions in their very own system, DEX transactions occur immediately on the blockchain, making them extra open and protected.

What Are the Potential Advantages of Constructing a DEX?

Making a decentralized alternate platform affords a lot potential, particularly in the case of creating wealth.

In distinction to centralized exchanges, DEX house owners might generate income from a wide range of sources: transaction charges, token itemizing, and LPs’ incentivization, plus governance tokens.

A DEX can even generate a substantial income stream by both introducing a local token or charging small charges on trades whereas nonetheless maintaining the charges low for the customers.

One other advantage of DEXs is that they’re immune to censorship, that means they’re extra problematic to close down or management. Anybody with on-line entry and a crypto pockets can participate in buying and selling, which is nice for areas the place traditional banking is restricted.

On high of that, DEXs usually listing a greater variety of tokens, together with newer or less-known ones which may not be accessible on centralized exchanges, giving merchants extra probabilities to discover totally different initiatives.

What Steps Are Concerned in Creating a Decentralized Trade?

More often than not, DEXs are made open-source, which signifies that any social gathering can see precisely how they work. That additionally means builders can take pre-existing code and adapt it to construct up new competing initiatives. However how is the creation course of structured?

Getting Began and Setting Targets

If you wish to create a DEX, you need to begin the method with preliminary planning and necessities groping, throughout which you’ll stipulate the options your DEX goes to have.

Specifically, it includes deciding on the token to be supported, how the liquidity will likely be organized, and what sort of consumer expertise you wish to present.

Creating the Entrance-Finish and Consumer Interface

After planning, your efforts should be directed towards the frontend and consumer interface growth. Your DEX goes to work together with actual customers, and thus, it must be user-friendly and simple to navigate.

Selecting the Proper Blockchain for the DEX

Then, you’ll go for the choice of the correct blockchain. The selection of blockchain would be the base of your DEX that can decide the pace of the transaction, its safety, and costs.

Whereas Ethereum is a regular selection for most individuals, you would possibly take into account different blockchains similar to Binance Good Chain or Solana if you’d like decrease charges and quick processing time.

Setting Up Liquidity and Value-Setting Instruments

Then, the setup of liquidity swimming pools and AMMs must be achieved. Liquidity swimming pools are principally vital with the intention to guarantee that there’s not less than an honest quantity of liquidity for trades to undergo. AMMs themselves play an enormous position in setting costs primarily based on market provide and demand.

You shall resolve on the structure of such swimming pools and the imposition of AMMs in order that the buying and selling course of stays easygoing.

Delegating the Mission

When you plan to get a high-performing DEX however lack the in-house experience, you’ll be able to delegate the event mission to a software program growth firm, similar to SCAND.

Working with skilled blockchain builders who specialise in cryptocurrency alternate growth can guarantee your DEX is constructed with strong safety, flawless pockets integration, and scalability in thoughts.

A trusted growth firm can even implement new options, present 24/7 help, and monitor your DEX to regulate to any market circumstances and consumer calls for.

Creating Good Contracts

Then comes the work on sensible contract growth. Good contracts are the spine of your DEX, as they independently execute transactions and regulate all crucial operations and not using a intermediary.

Writing correct contracts and testing them for glitches or vulnerabilities is vital in demonstrating your platform or customers is not going to be uncovered to dangers.

Testing and Safety Opinions

Testing and safety audits are the following step. Earlier than launching, each a part of the platform—sensible contracts, UI, and total performance—must be examined.

Safety audits are of excessive significance to acknowledge and resolve any sort of vulnerabilities that will jeopardize consumer funds or the integrity of the platform normally.

Going Stay and Monitoring Your DEX

In any case testing is full and the safety is on level, it’s time to roll out your DEX and start monitoring. A launch signifies the start of operation in your on-line platform, however actually, that is the place the actual work begins since additional common updates and monitoring are wanted to make sure the DEX stays on high of its efficiency.

How Can You Guarantee Safety in Your DEX Platform?

Safety can’t be compromised for any DEX. With no central authority to step in if one thing goes flawed, customers are totally liable for defending their funds. Some frequent vulnerabilities within the DEX platform embody:

- Flash mortgage assaults

- Entrance-running assaults

- Reentrancy assaults

- Inadequate liquidity

To remain protected, use {hardware} wallets as a result of they retailer non-public keys offline, making them a lot more durable to compromise. For these utilizing software program wallets, in flip, it’s vital to arrange a powerful, distinctive password and allow two-factor authentication performance so as to add additional safety.

There are lots of phishing schemes within the crypto house, so customers should be vigilant. Phishing implies deceiving folks into offering pockets info by creating pretend websites or messages.

That’s why it’s vital to offer clear warnings and security suggestions to assist your target market spot and keep away from these scams.

One other robust safety measure is multi-signature wallets, which require a number of approvals earlier than the transaction goes by means of. This may make it actually onerous for hackers to steal funds, particularly in companies or high-value accounts.

Another necessity is restoration phrase backup. If a consumer loses entry to a pockets, the backup—ideally saved offline—is assurance that they don’t lose the funds perpetually.

Encryption additionally performs a distinguished position if you construct a decentralized alternate—if a hacker will get entry to a consumer’s machine, encryption helps assure they’ll’t steal non-public keys or private knowledge.

Components That Affect the Success of a Decentralized Crypto Trade

The success of a decentralized alternate of cryptocurrency depends on a mixture of elements that make or break its functionality to compete with different platforms.

Essentially the most vital of those is liquidity. With out ample belongings to commerce, customers will likely be dissatisfied with delayed transactions and dangerous costs, and they’ll transfer to extra established platforms.

To keep away from this, profitable DEXs workforce up with liquidity suppliers, use automated market makers, or provide rewards to stimulate customers to provide liquidity. And not using a regular circulate of belongings, even essentially the most superior platform received’t stand an opportunity.

In fact, essentially the most profitable platforms preserve issues easy, providing a clear interface, quick transactions, and simple pockets connections.

As a result of DEXs lack the everyday buyer help of centralized exchanges, prospects should be capable to navigate the platform independently. The extra user-oriented and beginner-friendly the expertise, the higher.

As well as, transparency goes a good distance—customers prefer to see open-source code, clear governance fashions, and a wholesome, lively group supporting the platform. When people belief a DEX, they’re additionally extra prone to stay lively and commerce there.

However safety isn’t the one factor that retains a DEX related—the crypto house strikes quick, and platforms that adapt to new developments—like layer-2 scaling, cross-chain buying and selling, or distinctive DeFi performance—have a a lot better shot at long-term success.

DEXs that deliver one thing contemporary to the desk, similar to decrease fuel charges or unique liquidity options, possess a major benefit over rivals.

How Do You Construct a DEX That Competes with Established Platforms like Uniswap?

It’s not easy to beat the giants like Uniswap, however if you happen to play your playing cards proper, then your DEX can get a repute as effectively. The key is to face out by offering one thing that others aren’t.

Perhaps it’s decrease charges, unique token listings, or professional-grade buying and selling instruments—no matter it might be, you could have one thing that may make people keen to make the change. In case your platform feels similar to each different DEX on the market, it’s going to be powerful to get traction.

But good options alone aren’t ample if nobody is conscious of them. That’s the place intelligent advertising steps in. Referral applications, token incentives, and partnerships with different DeFi initiatives can be utilized to draw merchants and liquidity suppliers.

Apart from that, social media and influencer collaborations can present your platform with the thrill it deserves. The extra people hear about your DEX, the extra keen they’ll be to try it out.

And let’s not neglect to remain forward of DeFi tendencies—if you happen to combine yield farming, staking, or governance tokens, you’ll give customers extra causes to stay round.

Merchants are continually trying to find the newest and best, so in case your DEX affords contemporary, thrilling options, it has a a lot better shot at gaining long-term traction.

What Are the Challenges in Making a Decentralized Trade?

Constructing a profitable DEX isn’t at all times a bit of cake. From technical roadblocks of blockchain growth to regulatory complications and hard competitors, there’s rather a lot to determine.

First, the tech facet of issues can get fairly difficult. DEXs depend on sensible contracts, which implies any bugs or vulnerabilities can result in critical safety dangers. On high of that, points like sluggish transactions, excessive fuel charges, and community congestion can frustrate customers in the event that they’re not dealt with correctly.

That’s why having a well-equipped growth workforce and a strategic tech stack is a should. You must be certain that your platform runs equally effectively regardless of the circumstances are, stays safe, and may scale as extra customers be part of.

Then, there’s the entire regulatory grey space. Whereas DEXs don’t have a government, that doesn’t imply they’re fully off the radar.

Governments are nonetheless negotiating regulate crypto buying and selling, and new guidelines might pop up at any time. Staying knowledgeable and ensuring your platform doesn’t run into authorized bother is essential to avoiding any main complications down the street.

And naturally, there’s competitors. The DeFi house is filled with new platforms which are launching on a regular basis, which implies standing out is an issue. Providing low charges, robust liquidity incentives, and distinctive options may also help, but it surely doesn’t cease there.

Retaining customers engaged with a easy expertise, steady updates, and robust group help is what actually makes a distinction in the long term.

FAQs

What’s a decentralized alternate, and the way does it differ from different exchanges?

A decentralized alternate permits customers to commerce immediately with each other with out the presence of a centralized authority. DEXs present larger management over belongings, higher privateness, and decrease vulnerability to hacking in comparison with conventional exchanges.

What are the main components required for decentralized alternate growth?

The foremost components for alternate growth are blockchain infrastructure, sensible contracts, liquidity swimming pools, and automatic market makers (AMMs). Collectively, they kind a decentralized and automatic buying and selling ecosystem.

How do sensible contracts work in a decentralized alternate?

Good contracts facilitate trustless, automated user-to-user transactions. Good contracts perform trades, handle liquidity, and carry out different processes on the DEX with out utilizing intermediaries.

What steps are concerned within the DEX growth course of?

The steps within the growth course of embody planning and requirement gathering, deciding on the suitable blockchain, incorporating liquidity swimming pools and AMMs, and securing the platform.

How can I create a decentralized alternate that pulls liquidity suppliers?

Incentivize liquidity suppliers with aggressive rewards, e.g., a share of transaction charges or preferential token listings. A sound liquidity mannequin and the power to listing a lot of tokens can even entice suppliers to your platform.