French telco group Iliad has submitted a proposal to UK-based Vodafone Group concerning the potential merger of their respective operations in Italy.

If profitable, the merger could have a huge impact on the Italian cell market, decreasing it from 5 gamers to 4, whereas additionally combining the fastened broadband operations of the 2 corporations.

The deal is not at all assured to undergo, nonetheless. Even when Vodafone’s response is constructive, regulatory authorities should then research its results on competitors.

Extra Particulars

The proposal values Vodafone Italy at €10.45 billion ($11.4 billion) and Iliad Italy at €4.45 billion.

Vodafone Group would receive 50% possession of the merged entity (dubbed NewCo) along with a €6.5 billion money fee and a €2.0 billion shareholder mortgage. Iliad, in the meantime, would get 50% of NewCo along with a €500 million money fee and a €2.0 billion shareholder mortgage.

As a part of the proposed transaction, Iliad would have a name choice on Vodafone Group’s fairness stake in NewCo and would be capable to purchase a block of 10% of the NewCo share capital yearly at a value per share equal to the fairness worth at closing. Within the occasion Iliad chooses to train the decision choices in full, this may generate an extra €1.95 billion in money for Vodafone Group.

Based mostly on Vodafone Italy’s estimated EBITDA after Lease (EBITDAaL) of €1.34 billion for FY 2024 (as per dealer consensus), the proposed transaction implies an EBITDAaL a number of of seven.8x. That is greater than the 7.1x EBITDAaL a number of provided by Iliad in its €11.25 billion takeover provide for Vodafone Italy in February 2022, which was rapidly rejected by Vodafone Group.

The merged enterprise can be anticipated to generate revenues of round €5.8 billion and EBITDAaL of approximatively €1.6 billion for the monetary 12 months ending March 31, 2024.

The merged enterprise can be anticipated to generate revenues of round €5.8 billion and EBITDAaL of approximatively €1.6 billion for the monetary 12 months ending March 31, 2024.

In line with Iliad, the financing of the transaction is supported by main worldwide banks and the deal has the unanimous assist of its board of administrators plus its fundamental shareholder, Xavier Niel.

Thomas Reynaud, Iliad Group CEO, commented: “The market context in Italy requires the creation of essentially the most revolutionary telecom challenger, with potential to compete and create worth in a aggressive surroundings. We consider that the profiles and complementary experience of Iliad and Vodafone in Italy would permit us to construct a robust operator with the flexibility and monetary energy to take a position for the long run.”

“NewCo can be totally dedicated to accelerating the nation’s digital transformation and particularly fiber adoption and 5G deployment, with greater than €4 billion of funding deliberate over the following 5 years,” he added.

Vodafone Background

Vodafone has been current in Italy since September 1995, when it launched as the primary competitors within the cell marketplace for incumbent operator Telecom Italia (TIM).

The corporate—initially often known as Omnitel—was based by plenty of shareholders, together with Olivetti, Bell Atlantic Worldwide (now Verizon Communications), and Telia Worldwide (now Telia Firm).

It rebranded as Omnitel Vodafone in January 2001 after which Vodafone Omnitel in Could 2002 in a bid to capitalize on the status of the UK-based Vodafone Group, which had come on board as an investor two years earlier. In Could 2003, the Omnitel moniker was dropped altogether, by which era Vodafone had been left because the 100% proprietor following the gradual departure of its companions.

Vodafone Italy launched 3G in 2004, 4G in October 2012, and 5G in June 2019.

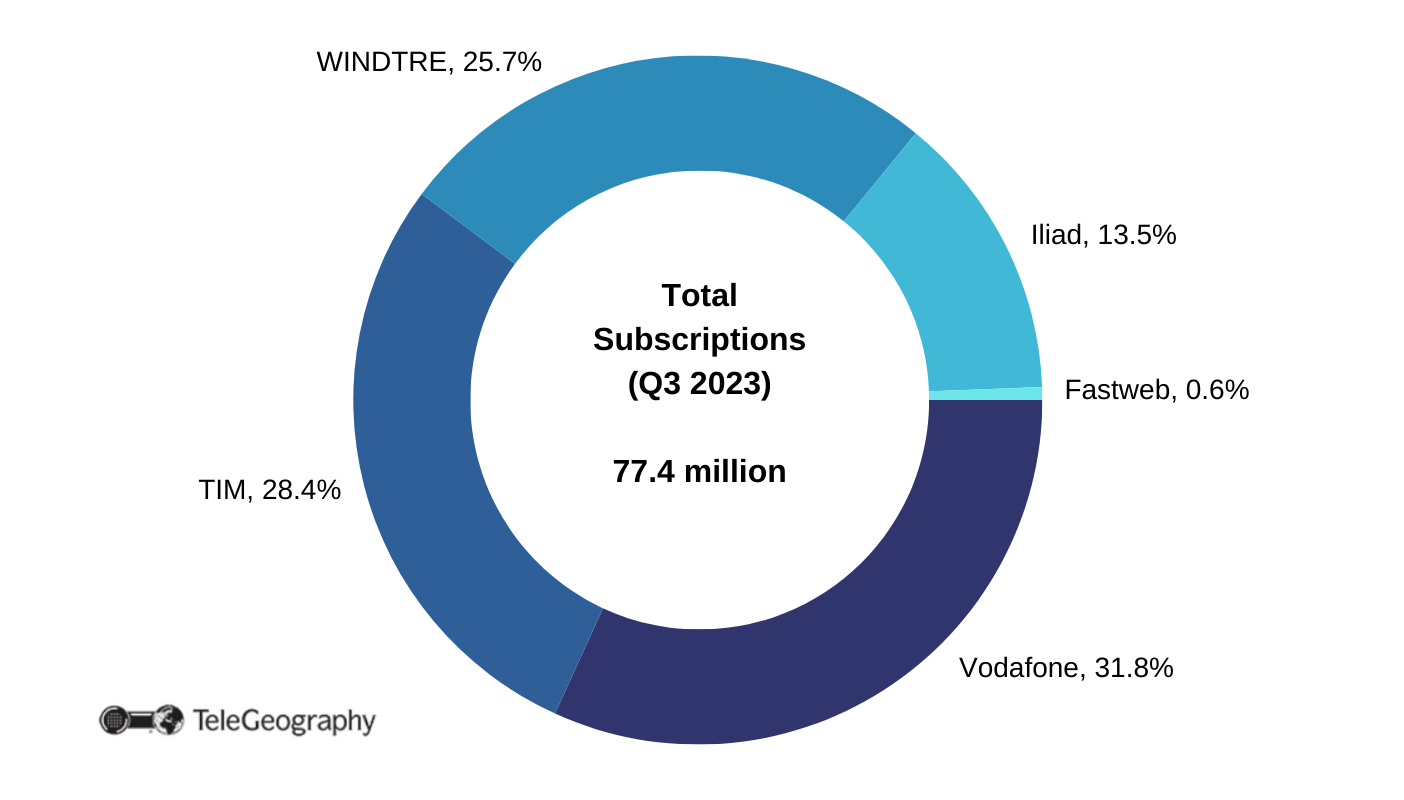

In line with TeleGeography’s GlobalComms Database, on the finish of September 2023, it had accrued an estimated 24.6 million cell subscriptions—together with clients of its MVNO companions however excluding M2M connections—making it the nation’s largest cellco with 32% of the market.

Within the fastened broadband sector, Vodafone gives a spread of entry merchandise based mostly on VDSL and fiber-to-the-home applied sciences, utilizing its personal networks plus these of wholesale companions. It additionally makes use of its 4G and 5G networks to attach households outdoors of the fastened community footprint.

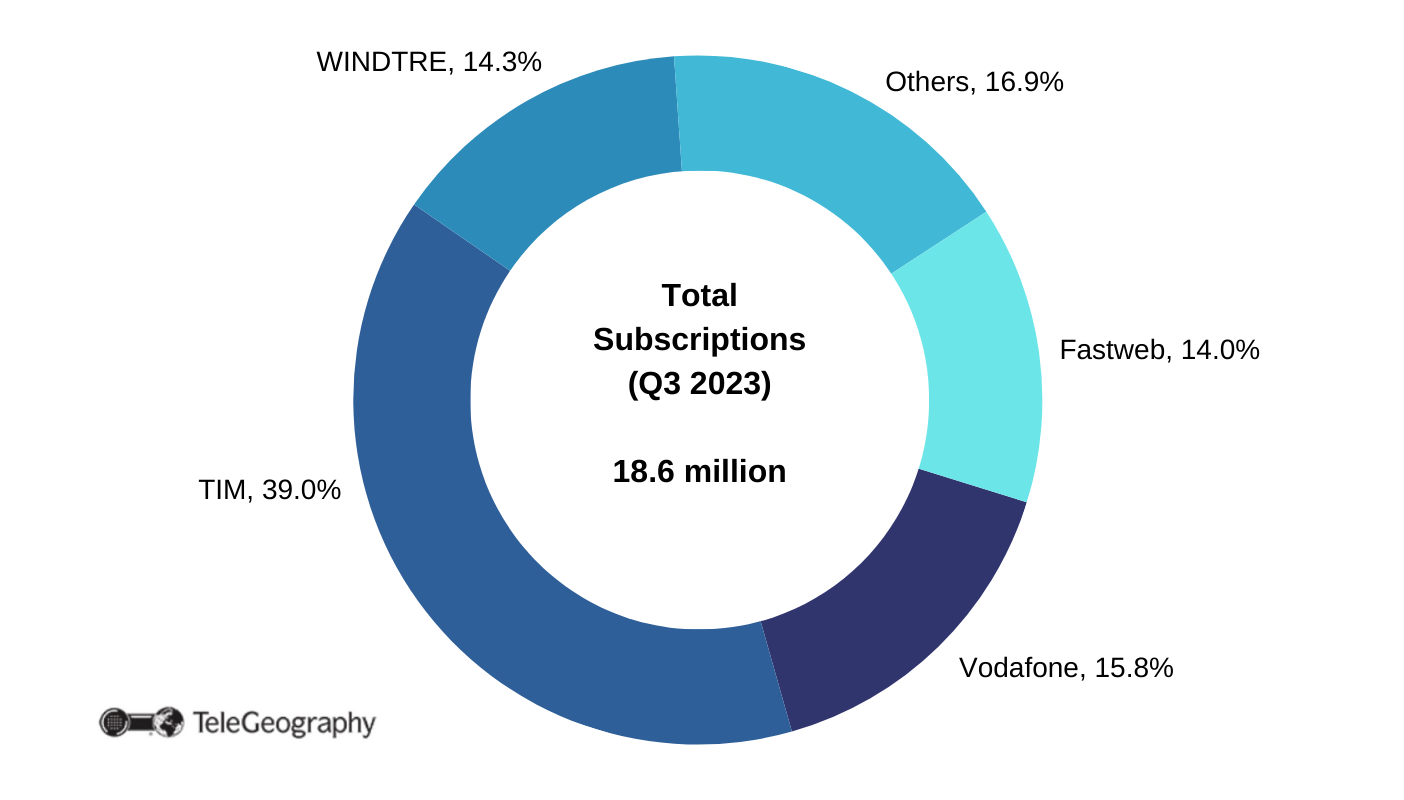

As of September 30, 2023, Vodafone had 2.95 million fastened broadband subscriptions.

Newer Challenger

Iliad Italy is a a lot youthful firm, established in 2016 to amass spectrum and a few community property from cell community operators (MNOs) 3 Italia and Wind Telecomunicazioni, which had agreed to a merger.

To be able to appease regulators nervous concerning the deal’s results on competitors, the pair created a “treatment package deal” to permit a brand new MNO to hitch the market.

Iliad finally launched cell companies in Could 2018, happening to win 5% of the general market inside twelve months and 10% by the primary quarter of 2021. As of September 30, 2023, Iliad had 10.48 million cell subscriptions and a 13.5% market share.

Italy Cell Market, Q3 2023

It joined Italy’s fastened broadband sector in January 2022, having signed wholesale agreements with the likes of Open Fiber and TIM. It had 172,000 broadband clients by end-September 2023.

Italy Mounted Broadband Market, Q3 2023